Balance Sheet Ratios + examples

- Sep 15, 2024

- 4 min read

Balance sheet ratios serve as indispensable tools in financial analysis.

They allow investors, analysts, and management to assess a company's financial health through various lenses.

These ratios not only examine a firm's liquidity, solvency, and profitability but also provide deeper insights when combined with other financial metrics.

While basic examples may suffice for a general understanding, detailed scenarios offer a richer perspective, particularly when you consider industry-specific factors, market conditions, and historical trends.

But how exactly can these ratios be applied in a real-world context, using more intricate formulas and cases?

1. Liquidity Ratios: Can Complex Assets and Liabilities Be Managed Efficiently?

Liquidity ratios help determine a company’s capacity to meet short-term liabilities.

However, in real-world cases, assets and liabilities often come with added complexities.

Beyond the standard current and quick ratios, companies might use variations to reflect more nuanced financial realities.

Current Ratio Formula:

For example, consider a company with current assets totaling $3,000,000, which includes cash of $500,000, trade receivables of $1,200,000, inventory valued at $1,000,000, and prepaid expenses of $300,000.

Its current liabilities amount to $1,500,000, consisting of accounts payable of $800,000, short-term loans of $500,000, and accrued expenses of $200,000.

The formula becomes:

A current ratio of 2.0 suggests that the company has twice as many current assets as current liabilities, indicating good liquidity.

However, let's delve deeper.

Inventory and prepaid expenses may not be quickly convertible to cash.

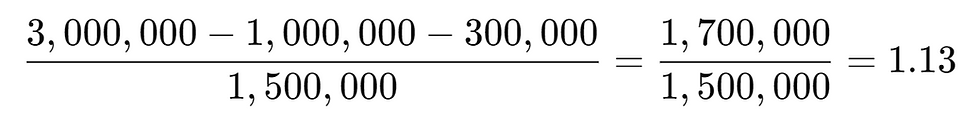

Adjusting for these less liquid assets:

The adjusted ratio of 1.13 presents a more conservative view of liquidity.

This highlights the importance of analyzing the composition of current assets to assess the true liquidity strength accurately.

Quick Ratio (Acid Test) Adjusted for Doubtful Receivables:

In some cases, not all receivables are equally reliable.

Let's have a look at an example where the same company has trade receivables of $1,200,000, but $400,000 is overdue by more than 90 days—raising doubts about collectibility.

The quick ratio formula is:

Adjusted for doubtful accounts, it becomes:

A quick ratio below 1 indicates that the company may not be able to fully cover its current liabilities without selling inventory, which may not be immediately liquid.

This underscores a potential need for better credit management and may signal liquidity issues if not addressed promptly.

2. Solvency Ratios: Analyzing Long-Term Stability in a More Complex Environment

Solvency ratios focus on the company’s ability to meet long-term obligations.

They often involve a more complex interplay between debt types, interest rates, and capital structures.

To gain a clearer picture, you need to consider not just total liabilities but also how these liabilities are structured over time.

Debt-to-Equity Ratio with Convertible Debt and Preferred Stock:

Suppose a company has total liabilities of $6,000,000, shareholders' equity of $2,500,000, and preferred stock valued at $1,000,000, which can be treated as either debt or equity depending on its terms.

Additionally, the company has issued convertible bonds worth $1,500,000.

The unadjusted debt-to-equity ratio is:

If we consider both preferred stock and convertible bonds as debt due to obligatory dividends and interest payments, the adjusted liabilities become $8,500,000:

A debt-to-equity ratio of 3.4 indicates high leverage, suggesting greater financial risk.

However, in industries like utilities or telecommunications, such ratios may be standard due to capital intensity.

Investors must evaluate whether the company's earnings can support this level of debt.

Interest Coverage Ratio with Variable Interest Rates and Debt Covenants:

Interest coverage ratios provide insight into how well a company can cover its interest expenses.

Let's consider a scenario where the company's EBIT is $1,200,000, and it has the following interest obligations:

Fixed-rate loans with annual interest of $300,000

Variable-rate debt with current interest of $200,000, which may increase if market rates rise

Subordinated debt with interest of $100,000, subject to debt covenants

The total interest expenses are:

The interest coverage ratio is:

Now, suppose market interest rates increase, raising the variable-rate debt interest to $250,000, and the subordinated debt covenant requires an additional interest payment of $50,000 due to a breach in financial ratios.

The new total interest expenses become:

The adjusted interest coverage ratio is:

A declining interest coverage ratio may raise concerns about the company's ability to meet its interest obligations, especially under changing market conditions.

This highlights the need for proactive financial management to mitigate interest rate risks.

3. Profitability Ratios: Evaluating Performance with Asset Revaluations and Equity Changes

Profitability ratios assess how efficiently a company generates earnings relative to its assets, equity, and revenues.

These ratios become particularly insightful when they account for factors such as asset revaluations, impairments, or share repurchases.

Return on Assets (ROA) with Asset Impairments and Revaluations:

Consider a company with a net income of $1,500,000 and total assets of $10,000,000.

Initially, the ROA is:

Suppose the company undergoes an asset revaluation, and certain assets are impaired by $1,000,000 due to market declines, reducing total assets to $9,000,000.

The adjusted ROA becomes:

While the ROA has improved, the asset impairment signals a loss in asset value, which may affect future earning potential.

It's essential to analyze whether the remaining assets can sustain or enhance profitability.

Return on Equity (ROE) with Equity Dilution from New Share Issuance:

Let's look at an example where a company has a net income of $1,500,000 and shareholders' equity of $5,000,000, resulting in an initial ROE of:

If the company issues new shares worth $2,000,000 to fund expansion, increasing shareholders' equity to $7,000,000, the adjusted ROE is:

The decrease in ROE indicates that the company now generates less profit per dollar of equity.

Investors need to assess whether the expected growth from the expansion justifies the dilution of existing equity and the potential impact on future returns.

_____

FOLLOW US FOR MORE.